Maximize Your 2026 Benefits: Unclaimed Government Funds Guide

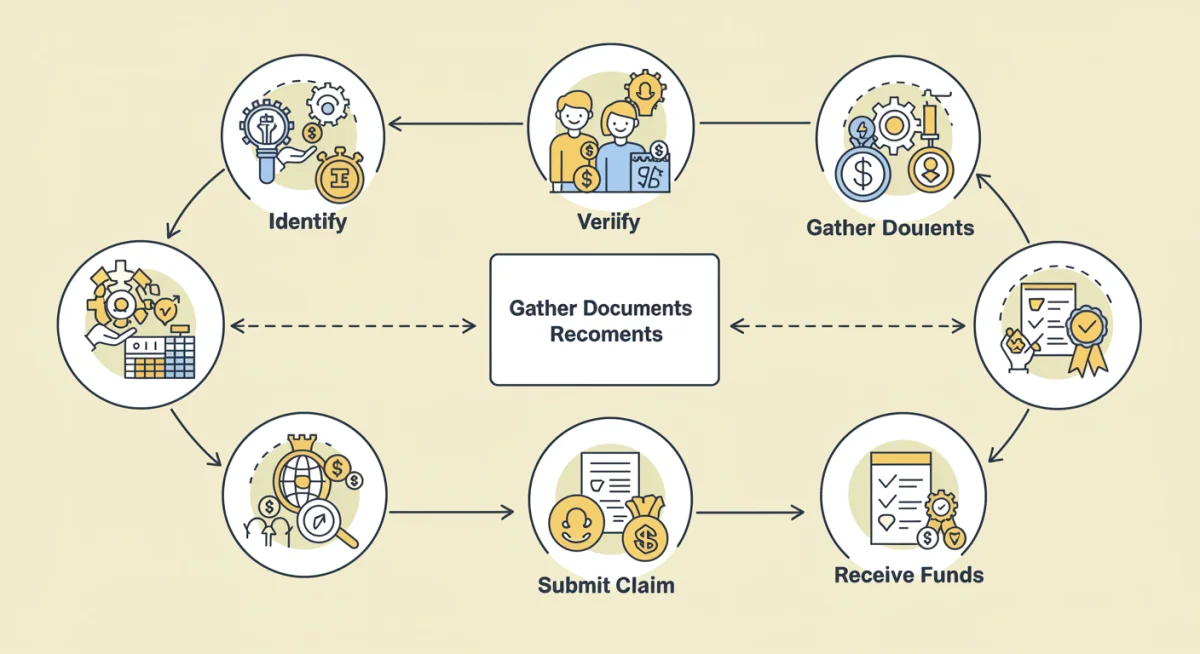

This guide provides a comprehensive 5-step process for U.S. citizens to identify and claim unclaimed government funds in 2026, ensuring you maximize your entitled benefits and recover forgotten assets.

Are you aware of the significant amount of money sitting in government coffers, just waiting to be claimed? In 2026, many Americans may still be overlooking potential benefits. This guide will show you how to maximize your 2026 benefits: a 5-step guide to unclaimed government funds, helping you recover what is rightfully yours.

Understanding Unclaimed Government Funds

Unclaimed government funds represent a vast pool of money, often forgotten or simply unknown to their rightful owners. These funds can originate from various sources, including uncashed checks, forgotten utility deposits, dormant bank accounts, and even insurance policy payouts. Each year, billions of dollars are held by state and federal agencies across the United States, waiting for individuals, businesses, or heirs to step forward and claim them.

The reasons behind these unclaimed assets are diverse. Sometimes, a simple change of address can lead to an unreceived check. Other times, individuals might forget about a small deposit made years ago or be unaware they are beneficiaries of an old insurance policy. Regardless of the origin, these funds represent a tangible financial opportunity that many Americans are missing out on.

Common sources of unclaimed funds

Understanding where these funds typically come from is the first step in your search. Knowing the common categories can help you narrow down your investigation and focus your efforts on the most likely sources.

- State Treasury Departments: Often hold uncashed paychecks, forgotten bank accounts, utility deposits, and contents of safe deposit boxes.

- Federal Agencies: Can hold unclaimed tax refunds, veteran benefits, mature savings bonds, and even FHA mortgage insurance refunds.

- Insurance Companies: Funds from life insurance policies where beneficiaries are unaware or unable to be located.

- Courts: Unclaimed jury duty payments, restitution funds, or other court-ordered payouts.

By familiarizing yourself with these categories, you can approach your search more strategically. The sheer volume and variety of these funds mean that almost anyone could have something waiting for them. It’s an often-overlooked aspect of personal finance that can yield surprising results.

In essence, unclaimed government funds are not a myth but a very real and accessible resource. Taking the time to understand their nature and typical origins sets the stage for a successful recovery process. It’s about being informed and proactive in securing your financial well-being.

Step 1: Initiating Your Search – Official Databases

The journey to recovering unclaimed government funds begins with a systematic search across official databases. This initial step is crucial as it guides you to legitimate sources and helps avoid fraudulent schemes. Relying solely on official government portals ensures the accuracy and security of your information during the search.

Many people are unaware of the centralized resources available to them. Governments at both federal and state levels maintain extensive databases specifically designed to help citizens locate their unclaimed property. These platforms serve as the primary gateway to uncovering forgotten assets, offering a user-friendly interface for public access.

Key federal and state search portals

To start your search, focus on these primary resources. They are the most reliable and comprehensive tools at your disposal for finding unclaimed government funds.

- USA.gov: The official portal for the U.S. government, providing links to various federal agencies that may hold unclaimed funds. This is an excellent starting point for federal-level searches.

- National Association of Unclaimed Property Administrators (NAUPA) – MissingMoney.com: This is a multi-state database where you can search for unclaimed property held by participating states. It’s an invaluable tool for a broad search across different states simultaneously.

- State Treasury Websites: Each state has its own unclaimed property division. Even if you’ve used MissingMoney.com, it’s often wise to check individual state treasury websites directly, especially for states where you have lived or conducted business.

When using these portals, be prepared to enter various pieces of personal information, such as your full name, previous addresses, and potentially social security numbers. This information is critical for matching you with any existing records. Always ensure you are on a secure, official government website before inputting sensitive data.

Remember, the search is free. Be wary of any service that charges a fee upfront to search for or claim your money. While some legitimate asset locators exist, they typically only charge a percentage of the recovered funds after a successful claim.

By diligently exploring these official databases, you lay a strong foundation for identifying any potential unclaimed funds. This proactive approach significantly increases your chances of a successful recovery, bringing you closer to maximizing your 2026 benefits.

Step 2: Verifying and Cross-Referencing Your Findings

Once you’ve identified potential matches for unclaimed funds, the next critical step is verification and cross-referencing. It’s not enough to simply find a name on a list; you need to confirm that the listed funds genuinely belong to you. This stage involves a meticulous review of the information provided and, often, a comparison across multiple sources to ensure accuracy.

Verification is essential to prevent misidentification and to streamline the subsequent claiming process. An incorrect claim can lead to delays or even rejection, so investing time in this step is highly beneficial. Pay close attention to details like names, addresses, and the type of property listed.

Tips for accurate verification

When reviewing potential matches, keep these guidelines in mind to ensure you’re pursuing legitimate claims for unclaimed government funds:

- Exact Name Matches: Confirm that the name listed precisely matches your legal name or any variations you might have used (e.g., maiden name, middle initial).

- Past Addresses: Cross-reference the listed address with all your previous residences. Even a minor discrepancy can be a red flag or require further investigation.

- Property Type: Understand the nature of the unclaimed property. Is it an uncashed check, a forgotten bank account, or an insurance payout? Knowing the type helps in gathering appropriate documentation.

- Source Agency: Note which agency or entity is holding the funds. This will be crucial for the next steps in the claiming process.

It’s also advisable to cross-reference findings from different databases. If you found a potential match on MissingMoney.com, try to confirm the details on the specific state’s treasury website. This dual verification adds an extra layer of certainty to your claim.

Be skeptical of any claims that seem too good to be true or require immediate action without proper verification. Scammers often target individuals searching for unclaimed money. Always prioritize official government channels for confirmation.

By carefully verifying and cross-referencing your findings, you significantly increase the likelihood of a successful claim. This meticulous approach ensures that you are pursuing legitimate funds and are well-prepared for the documentation phase, moving you closer to maximizing your 2026 benefits.

Step 3: Gathering Essential Documentation for Your Claim

Once you’ve verified that unclaimed funds likely belong to you, the next crucial step is to gather all necessary documentation. This phase is paramount because government agencies require specific proofs of identity and ownership to process claims. Without the correct paperwork, even a legitimate claim can face delays or rejection.

The type of documentation required can vary depending on the nature of the unclaimed property and the agency holding it. However, a core set of documents is almost universally requested. Being prepared with these items beforehand will significantly expedite your claim process.

Key documents you will likely need

To successfully claim your unclaimed government funds, ensure you have these documents readily available:

- Proof of Identity: A government-issued photo ID, such as a driver’s license or passport, is always required.

- Proof of Social Security Number: Your Social Security card or a document displaying your full SSN (e.g., a W-2 form).

- Proof of Address: Documents like utility bills, bank statements, or official mail that show your current and any relevant previous addresses associated with the unclaimed property.

- Proof of Ownership/Relationship: Depending on the type of fund, this could include old bank statements, uncashed checks, insurance policy documents, death certificates (for heirs), or court documents.

It’s advisable to gather both original documents and clear photocopies. While some agencies might accept digital submissions, having physical copies can be useful. If you are claiming funds on behalf of a deceased person, you will also need documents proving your legal right to act as their representative, such as letters of administration or a will.

Additionally, some claims might require a notarized signature, so be prepared to visit a notary public if instructed. Always double-check the specific requirements of the agency you are filing with, as these can differ slightly state by state or federal agency by federal agency. Many agencies provide a checklist of required documents on their website.

By meticulously gathering all essential documentation, you not only demonstrate your rightful ownership but also show due diligence. This organized approach minimizes potential hurdles, ensuring a smoother and faster path to recovering your unclaimed government funds and maximizing your 2026 benefits.

Step 4: Submitting Your Claim and Following Up

With all your documentation prepared, the next step is to formally submit your claim. This is where your diligent research and preparation pay off. The submission process typically involves filling out an official claim form, attaching your supporting documents, and sending them to the appropriate government agency. However, the journey doesn’t end with submission; consistent follow-up is equally vital.

Each state or federal agency will have its own specific claim form, often available for download from their website. It is crucial to fill out these forms completely and accurately, as any missing information or errors could lead to delays or the outright rejection of your claim. Pay close attention to instructions regarding how to submit the form – whether by mail, online portal, or in person.

Best practices for claim submission and follow-up

To ensure a smooth claim process for your unclaimed government funds, consider these best practices:

- Complete Forms Accurately: Double-check all fields for correctness and completeness. Ensure your signature is present where required.

- Organize Documents: Attach supporting documents in an organized manner, perhaps with a cover sheet listing all enclosed items. Make copies of everything you submit for your records.

- Choose Secure Submission: If mailing, consider using certified mail with a return receipt to track delivery. If submitting online, ensure the portal is secure and print or save confirmation pages.

- Record Key Details: Keep a detailed log of your submission date, confirmation numbers, and the names of any representatives you speak with.

- Follow Up Systematically: If you don’t hear back within the stated processing time, initiate follow-up calls or emails. Be polite but persistent.

Processing times for unclaimed funds claims can vary significantly, ranging from a few weeks to several months, depending on the complexity of the claim and the volume of requests the agency is handling. Patience is key, but so is proactive follow-up. Don’t assume your claim is being processed if you don’t hear anything; always verify its status.

During follow-up, have all your submission details ready, including claim numbers and submission dates. This will help the agency quickly locate your file. If there are any issues or requests for additional information, respond promptly and provide exactly what is asked.

By meticulously submitting your claim and maintaining consistent follow-up, you significantly increase your chances of a timely and successful recovery. This systematic approach ensures that you remain in control of the process, ultimately leading to the successful retrieval of your unclaimed government funds and maximizing your 2026 benefits.

Step 5: Maximizing Your 2026 Benefits Beyond Unclaimed Funds

While recovering unclaimed government funds is a significant step towards financial well-being, maximizing your 2026 benefits extends beyond this initial recovery. It involves adopting a proactive approach to managing your finances and being aware of other potential benefits and opportunities. The aim is to create a comprehensive strategy that ensures you are not leaving any money on the table, now or in the future.

Many individuals focus solely on what they’ve lost, but it’s equally important to look forward and understand how to prevent future unclaimed assets and identify new avenues for financial growth. This holistic perspective empowers you to take full advantage of all available resources and programs.

Strategies for ongoing financial optimization in 2026

Consider these strategies to continue maximizing your benefits long after you’ve claimed your unclaimed government funds:

- Regularly Check for Unclaimed Property: Make it a habit to check state and federal databases annually. Changes in life circumstances can lead to new unclaimed assets.

- Update Contact Information: Always ensure your bank, insurance providers, employers, and government agencies have your most current address and contact details.

- Review Financial Accounts: Periodically audit your bank accounts, investment portfolios, and insurance policies to ensure all are active and properly managed.

- Explore Other Government Programs: Research other federal and state benefit programs you might qualify for, such as energy assistance, housing aid, or educational grants.

- Financial Literacy: Invest in improving your financial literacy. Understanding budgeting, saving, and investment principles can help you better manage your assets and prevent future losses.

Additionally, consider setting up direct deposit for all income and benefits to reduce the risk of uncashed checks. For any paper checks you do receive, deposit them promptly. For important documents like insurance policies or stock certificates, keep them in a safe and accessible place, and inform a trusted family member of their location.

Maximizing your benefits in 2026 is an ongoing process that requires vigilance and proactive engagement with your financial landscape. By combining the recovery of past unclaimed funds with forward-looking financial management, you establish a robust foundation for enduring financial security and prosperity.

Preventing Future Unclaimed Funds and Staying Informed

Recovering existing unclaimed funds is a triumph, but preventing new funds from becoming unclaimed is equally important for long-term financial health. The steps you take today can significantly reduce the likelihood of your assets becoming lost in the future. This involves adopting proactive habits and staying continuously informed about your financial accounts and government interactions.

The primary reasons funds become unclaimed often boil down to outdated information, forgotten accounts, or a lack of awareness. By addressing these root causes, you can build a more secure financial future and ensure that your money always finds its way to you.

Key practices for prevention and awareness

Implement these practices to prevent your assets from becoming unclaimed government funds in the future and to stay well-informed:

- Maintain Current Records: Always update your address, phone number, and email with all financial institutions, employers, and government agencies.

- Consolidate Accounts: If you have multiple small bank accounts or investment portfolios, consider consolidating them to simplify management and reduce the chance of forgetting them.

- Regular Account Review: Schedule annual reviews of all your financial accounts, including dormant ones, to ensure they are active and accessible.

- Beneficiary Updates: Keep beneficiaries on life insurance policies, retirement accounts, and other assets up-to-date, especially after major life events.

- Digital Record Keeping: Utilize digital tools and secure online portals to track your financial assets and communications with institutions.

Additionally, be proactive about uncashed checks. If you receive a check, deposit or cash it promptly. For direct deposits, ensure your bank information is correct with all payers. If you move, forward your mail to your new address and, more importantly, directly update your address with all relevant entities.

Staying informed also means understanding state escheatment laws, which dictate how long an asset must be dormant before it is turned over to the state as unclaimed property. While you don’t need to be an expert, a basic understanding can help you anticipate when accounts might be at risk.

By embedding these preventative measures into your financial routine, you create a robust defense against losing track of your money. This ongoing vigilance ensures that you consistently maximize your 2026 benefits and maintain full control over your financial assets, avoiding the need to search for unclaimed funds again.

| Key Step | Brief Description |

|---|---|

| Search Databases | Utilize official federal and state portals like USA.gov and MissingMoney.com. |

| Verify Findings | Cross-reference details like names, addresses, and property type across sources. |

| Gather Documents | Collect proof of identity, SSN, address, and ownership for your claim. |

| Submit & Follow Up | Submit claim forms accurately and track progress with the relevant agency. |

Frequently asked questions about unclaimed government funds

Unclaimed government funds are financial assets held by state or federal agencies that belong to individuals or businesses but have not been claimed by their rightful owners. These can include uncashed checks, forgotten deposits, insurance payouts, or even contents from safe deposit boxes.

No, searching for and claiming unclaimed government funds through official state or federal websites is always free. Be cautious of any services that demand an upfront fee for searching. While some legitimate asset locators exist, they typically only charge a percentage of recovered funds after a successful claim.

It is advisable to check for unclaimed funds at least once a year. Life changes such as moving, job changes, or forgotten accounts can lead to new unclaimed assets. Regular checks ensure you stay on top of any money that might be waiting for you.

Commonly required documents include a government-issued photo ID, proof of Social Security Number, proof of current and previous addresses, and evidence of ownership or relationship to the funds (e.g., old bank statements, death certificates for heirs). Specific requirements may vary by agency.

Yes, heirs or legal representatives can claim unclaimed funds belonging to a deceased individual. You will typically need to provide proof of identity, the deceased’s death certificate, and documents establishing your legal right to the estate, such as a will or letters of administration.

Conclusion

Navigating the landscape of unclaimed government funds can seem daunting, but with a clear, step-by-step approach, it becomes an accessible path to financial recovery. This guide has outlined the essential actions needed to identify, verify, claim, and ultimately maximize your 2026 benefits. From diligently searching official databases to meticulously gathering documentation and staying vigilant against future losses, each step contributes to securing your rightful assets. By adopting these strategies, you empower yourself to reclaim forgotten funds and maintain a proactive stance on your financial well-being, ensuring that no money is left behind.