Smart Spending Habits 2026: 7-Day Impulse Buy Challenge

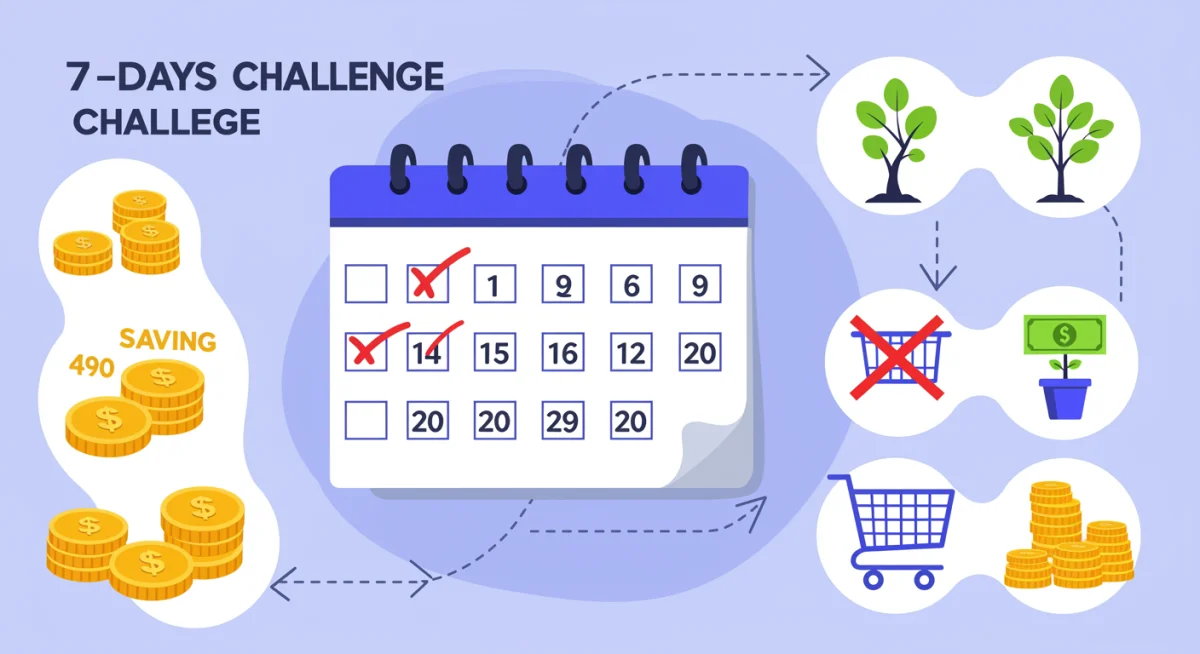

Implementing smart spending habits in 2026 through a 7-day challenge can significantly reduce impulse buys by 30%, leading to enhanced financial stability and mindful consumption.

Are you ready to transform your financial future in 2026? This year presents a unique opportunity to cultivate smart spending habits, particularly by tackling the pervasive issue of impulse buying. Join us on a transformative 7-day challenge designed to reduce your impulse purchases by a remarkable 30%, setting a new standard for your financial well-being.

Understanding Impulse Buying in 2026

Impulse buying, often driven by emotion rather than necessity, remains a significant hurdle for many seeking financial stability. In 2026, with constant digital advertisements and personalized marketing, the temptations are more prevalent than ever. Recognizing the triggers and psychological underpinnings of these spontaneous purchases is the first step toward gaining control.

The digital landscape has amplified impulse buying. Online retailers frequently employ tactics like one-click purchases, limited-time offers, and personalized recommendations, making it incredibly easy to spend without much thought. Understanding these sophisticated strategies is crucial for building a defense against them.

The Psychology Behind Instant Gratification

Our brains are wired for instant gratification. When we see something we desire, a rush of dopamine can override our rational decision-making processes. This biological response is often exploited by marketers, leading to purchases we later regret.

- Emotional Triggers: Stress, boredom, or even happiness can lead to impulsive shopping as a coping mechanism or celebration.

- Scarcity & Urgency: Phrases like ‘limited stock’ or ‘flash sale’ create a fear of missing out (FOMO), compelling immediate action.

- Social Influence: Seeing others acquire new items, especially through social media, can trigger a desire to keep up.

Identifying Your Personal Triggers

Before you can reduce impulse buys, you need to know what specifically triggers them for you. This self-awareness is a cornerstone of developing smart spending habits. Take some time to reflect on your past purchases and pinpoint the circumstances that led to them.

Consider keeping a spending journal for a few days before starting the challenge. Note down not just what you bought, but also why you bought it, how you felt before and after the purchase, and where you were when the decision was made. This detailed record will reveal patterns.

Understanding the root causes of your impulse buys in 2026 will empower you to create targeted strategies. Whether it’s a specific time of day, a particular type of advertisement, or an emotional state, identifying these factors is key to breaking the cycle. This foundational understanding sets the stage for a successful 7-day challenge.

Day 1: The “No-Spend” Kickoff

To truly embrace smart spending habits, Day 1 of our challenge begins with a strict “no-spend” day. This means absolutely no discretionary spending. The goal is to highlight how much we unconsciously spend and to reset our spending baseline. It’s an immediate, impactful way to bring awareness to your daily financial decisions.

The “no-spend” day isn’t about deprivation permanently, but about observation. It forces you to confront your needs versus your wants and to get creative with resources you already possess. Many participants are surprised by how much they save and how little they actually miss.

Setting Clear Boundaries

For Day 1, define what constitutes “no-spend.” Typically, this excludes essential bills like rent or utilities, but includes everything else. This might mean packing a lunch, skipping your morning coffee run, or avoiding online shopping altogether.

- Essential vs. Discretionary: Clearly distinguish between what you absolutely need to survive and what is an extra.

- Avoid Temptation Zones: Steer clear of shops, online marketplaces, and social media feeds that promote consumption.

- Plan Alternatives: Have free activities or homemade meals ready to prevent boredom or hunger from leading to spending.

Reflecting on Your Spending Habits

At the end of Day 1, take time to reflect. How did it feel? What were the biggest challenges? Did you notice any patterns or cravings you hadn’t before? This introspection is vital for understanding your relationship with money and consumption.

Many find that the biggest challenge isn’t the lack of money, but the habit of spending. The morning coffee, the afternoon snack, the casual browse online – these small, habitual expenditures add up. Recognizing these habits is the first step towards consciously changing them throughout the rest of the challenge.

Day 1’s “no-spend” rule is a powerful jolt to your financial system. It provides immediate insight into your daily spending patterns and sets a strong foundation for the remaining days of the challenge. This initial step is crucial for developing lasting smart spending habits.

Day 2: Unsubscribe and Unfollow

On Day 2, we focus on digital decluttering to reduce exposure to marketing triggers. Unsubscribe from promotional emails and unfollow social media accounts that encourage impulse purchases. Less exposure means fewer temptations, making it easier to stick to your smart spending habits.

Our inboxes and social media feeds are inundated with carefully crafted advertisements designed to make us buy. By actively removing these influences, you create a cleaner, less tempting digital environment, which is essential for maintaining financial discipline in 2026.

Digital Detox for Your Wallet

Take dedicated time to go through your email subscriptions. Be ruthless. If an email consistently promotes items you don’t need or encourages spending, unsubscribe. Do the same for social media; unfollow influencers or brands that trigger your impulse buying tendencies.

- Email Purge: Search your inbox for promotional emails and unsubscribe from all non-essential lists.

- Social Media Audit: Review who you follow on platforms like Instagram, TikTok, and Facebook. If they primarily showcase new products you’re tempted to buy, unfollow them.

- Ad Blocker Installation: Consider installing an ad blocker on your browser to minimize exposure to online advertisements.

Creating a Mindful Online Environment

The goal isn’t to disconnect entirely, but to curate an online experience that supports your financial goals. Replace consumption-focused content with educational or inspirational material that aligns with your values. This proactive approach helps reinforce your commitment to smart spending habits.

Many individuals find that once they reduce their exposure to constant product promotion, their desire for new items naturally diminishes. It’s about shifting your focus from acquiring to appreciating what you already have, or to investing in experiences rather than material goods. This shift is a powerful component of long-term financial health.

By taking control of your digital environment on Day 2, you actively reduce the external pressures that contribute to impulse buying. This step is a proactive measure that empowers you to control your financial narrative rather than being swayed by external influences.

Day 3: The 24-Hour Rule Implementation

Day 3 introduces the crucial 24-hour rule. For any non-essential purchase over a certain amount (e.g., $20 or $50), you must wait a full 24 hours before buying it. This simple yet effective strategy provides a buffer against immediate gratification and allows for rational decision-making, a pillar of smart spending habits.

Often, the urge to buy is fleeting. By introducing a mandatory waiting period, you give yourself space to evaluate if the item is truly needed or if it’s just a temporary desire. This pause can save you from countless regrettable purchases and reinforce mindful consumption.

How the 24-Hour Rule Works

When you encounter something you’re tempted to buy, instead of adding it to your cart or taking it to the checkout, add it to a “wish list” or simply make a mental note. Then, walk away. Revisit the idea 24 hours later. You’ll often find the urge has passed, or you’ve realized you don’t actually need it.

- Set a Threshold: Determine a specific dollar amount above which the 24-hour rule applies.

- Physical vs. Online: Apply the rule consistently, whether you’re shopping in a store or browsing online.

- Evaluate Necessity: During the waiting period, consider if the item aligns with your values and existing budget.

Benefits Beyond Savings

The 24-hour rule does more than just save you money; it cultivates patience and discipline. It trains your brain to resist immediate urges and to prioritize long-term financial goals over short-term desires. This mental shift is invaluable for developing sustainable smart spending habits.

Many people discover that after the 24 hours, the item no longer holds the same appeal. The excitement of the potential purchase often fades, revealing that the desire was more about the thrill of acquisition than the actual utility or value of the item. This practice strengthens your ability to differentiate between genuine needs and fleeting wants.

Implementing the 24-hour rule on Day 3 empowers you to regain control over your purchasing decisions. It’s a pragmatic tool that fosters intentionality and significantly reduces the likelihood of impulse buys, moving you closer to your financial goals in 2026.

Day 4: Budget Review and Adjustment

On Day 4, it’s time to dive into your budget. Review your current spending, identify areas where impulse buys have occurred, and make necessary adjustments. A well-defined budget is the backbone of smart spending habits, providing a clear roadmap for your money.

Many people have a budget, but few regularly review and adjust it. This challenge emphasizes the dynamic nature of budgeting. Your financial situation and priorities change, and your budget should reflect that, especially when aiming to curb impulse spending.

Analyzing Your Spending Patterns

Pull up your bank statements, credit card bills, or budgeting app. Categorize your expenses and pay close attention to any purchases that seem unnecessary or were made on a whim. This data will reveal where your money is truly going.

- Track Everything: Use an app or spreadsheet to meticulously record every expense for at least a week.

- Identify Leakage Points: Look for recurring small purchases that add up, or large, one-off impulse buys.

- Compare to Goals: See if your spending aligns with your financial objectives for 2026 and beyond.

Making Strategic Adjustments

Based on your analysis, reallocate funds from categories where impulse buys are prevalent to savings or other essential needs. This might mean reducing your entertainment budget or setting a strict limit on online shopping. Be realistic but firm with your new allocations.

The goal isn’t to create an overly restrictive budget that is impossible to follow, but rather one that supports your smart spending habits. Think of it as a living document that evolves with your financial journey. Small, consistent adjustments can lead to significant long-term savings and a healthier relationship with money.

Day 4 solidifies your commitment to smart spending habits by actively engaging with your budget. By understanding where your money goes and proactively making adjustments, you build a stronger financial framework that naturally deters impulse purchases.

Day 5: Cultivating Mindful Consumption

On Day 5, we shift focus to cultivating mindful consumption. This means being intentional about every purchase, asking yourself if an item truly adds value to your life, and considering its long-term impact. Mindful consumption is a core component of sustainable smart spending habits.

It’s about moving beyond simply avoiding impulse buys to actively making conscious choices. This involves considering the environmental impact, ethical sourcing, and genuine need for an item before bringing it into your life. It’s a holistic approach to spending.

Questions to Ask Before Buying

Before any purchase, engage in a quick mental checklist. These questions help you pause and evaluate the true necessity and value of the item, preventing emotional decisions from taking over.

- Do I truly need this, or do I just want it? Differentiate between essential needs and fleeting desires.

- Do I already own something similar that serves the same purpose? Avoid duplicate purchases.

- Does this align with my values and long-term financial goals? Ensure purchases contribute positively to your life.

- Can I afford this without compromising other financial priorities? Assess the financial impact.

Practicing Intentionality

Mindful consumption extends beyond just purchases. It’s about appreciating what you have and finding joy in experiences rather than material possessions. This shift in mindset can dramatically reduce the desire for new things.

Consider the “use it up, wear it out, make it do, or do without” philosophy. This encourages resourcefulness and reduces waste, while simultaneously saving money. By consciously choosing to consume less and more thoughtfully, you strengthen your smart spending habits and contribute to a more sustainable lifestyle in 2026.

Day 5 encourages a deeper connection with your spending, fostering a sense of purpose and intentionality. By adopting mindful consumption practices, you move beyond simple avoidance of impulse buys to a more deliberate and fulfilling approach to your finances.

Day 6: Finding Free or Low-Cost Entertainment

Day 6 addresses a common trigger for impulse spending: boredom or the desire for entertainment. We challenge you to explore free or low-cost activities that bring joy without breaking the bank. This reinforces smart spending habits by demonstrating that fun doesn’t always come with a price tag.

Many impulse buys occur when we’re looking for a quick pick-me-up or a way to fill time. By having a repertoire of enjoyable, inexpensive alternatives, you reduce the likelihood of turning to shopping as a form of entertainment.

Unlocking Local and Digital Resources

Your community and the internet offer a wealth of free resources. Explore local parks, libraries, free museum days, or community events. Online, you can find free courses, podcasts, documentaries, or virtual tours that offer enrichment without cost.

- Outdoor Activities: Hiking, biking, picnics, or simply enjoying a walk in nature.

- Library Resources: Books, movies, audiobooks, and even free passes to local attractions.

- Community Events: Check local calendars for free concerts, festivals, or workshops.

- Digital Exploration: Free online courses, educational videos, or virtual travel experiences.

Building a “Fun Without Funds” List

Create a personal list of activities you genuinely enjoy that cost little to no money. This list becomes your go-to whenever you feel the urge to spend out of boredom or for entertainment. Having these options readily available is a powerful deterrent to impulse buying.

The key is to shift your mindset from needing to buy happiness to finding joy in simple, accessible pleasures. This practice not only saves money but also often leads to more meaningful experiences and stronger connections with others. It’s an essential element of maintaining smart spending habits in the long run.

By discovering and embracing free or low-cost entertainment on Day 6, you proactively address a major impulse spending trigger. This strategy helps decouple enjoyment from expenditure, fostering a more financially resilient and resourceful lifestyle for 2026.

Day 7: Future-Proofing Your Smart Spending Habits

On the final day of our challenge, Day 7, we focus on cementing your new smart spending habits and establishing strategies for long-term success. This isn’t just about a 7-day sprint; it’s about building a foundation for sustained financial well-being in 2026 and beyond. Review your progress and plan for continued growth.

The goal is to integrate these practices into your daily life so they become second nature. Consistency is key to transforming temporary changes into permanent, positive behaviors that support your financial goals.

Automating Savings and Investments

One of the most effective ways to future-proof your finances is to automate your savings and investments. Set up automatic transfers from your checking account to your savings or investment accounts immediately after payday. This ensures you pay yourself first, reducing the temptation to spend that money impulsively.

- Direct Deposit Allocation: Have a portion of your paycheck automatically deposited into a separate savings account.

- Recurring Investments: Set up regular, small investments into a retirement fund or brokerage account.

- Emergency Fund Building: Prioritize building an emergency fund to avoid debt in unforeseen circumstances.

Continuous Learning and Adaptation

The financial landscape is always evolving. Stay informed about personal finance strategies, economic trends, and new opportunities for saving and investing. Regularly review your budget and adapt your smart spending habits as your life circumstances change.

Consider joining online communities or reading financial blogs to stay motivated and learn from others. The journey to financial mastery is ongoing, and continuous learning is a vital part of staying ahead and maintaining your discipline against impulse buying. Celebrate your successes and learn from any setbacks.

Day 7 is about solidifying the progress you’ve made and committing to a future of intentional financial decisions. By automating good behaviors and embracing continuous learning, you ensure that your smart spending habits will serve you well for many years to come.

| Key Challenge Day | Brief Description |

|---|---|

| Day 1: No-Spend Kickoff | Eliminate all discretionary spending to raise awareness of daily habits. |

| Day 3: 24-Hour Rule | Wait a full day before making non-essential purchases to prevent impulse buys. |

| Day 5: Mindful Consumption | Evaluate true need and value before buying, fostering intentional choices. |

| Day 7: Future-Proofing | Automate savings and commit to continuous learning for lasting financial health. |

Frequently Asked Questions About Smart Spending Habits

The primary goal is to reduce impulse purchases by 30% within a week, thereby cultivating more intentional and mindful spending habits. It aims to increase awareness of your financial decisions and lay the groundwork for long-term financial control and well-being in 2026.

To identify your triggers, keep a spending journal for a few days, noting what, why, and where you bought items, along with your emotions. This self-reflection helps reveal patterns, such as stress-induced shopping or specific marketing appeals, allowing you to address them directly.

Yes, a “no-spend” day is highly effective as it forces immediate awareness of your daily discretionary spending. It highlights how much you spend unconsciously and helps distinguish between needs and wants, serving as a powerful reset button for your financial behaviors and a strong start to the challenge.

The 24-hour rule requires you to wait a full day before making any non-essential purchase above a set amount. This pause allows emotional urges to subside, providing time for rational thought and evaluation of true necessity, significantly reducing regrettable impulse buys and fostering discipline.

To maintain these habits, automate savings and investments, making it a “pay yourself first” approach. Continuously review and adjust your budget, stay informed about personal finance, and actively seek free or low-cost entertainment. Consistency and adaptation are key to long-term financial success.

Conclusion

Embarking on the 7-day challenge to reduce impulse buys by 30% is more than just a temporary fix; it’s a strategic investment in your financial future. By understanding impulse triggers, implementing practical rules like the 24-hour waiting period, and cultivating mindful consumption, you lay a solid foundation for sustainable smart spending habits in 2026. This journey empowers you to make intentional choices, prioritize your financial well-being, and ultimately achieve greater control over your money, leading to a more secure and fulfilling life.