2026: Get Paid to Shop with Innovative Reward Programs

In 2026, innovative reward programs are transforming how consumers can get paid to shop, offering significant financial benefits and evolving beyond traditional cashback models. These platforms leverage advanced technology to provide personalized and lucrative opportunities for everyday purchases.

Are you ready to discover how to get paid to shop in 2026? The landscape of consumer rewards is undergoing a revolutionary transformation, moving far beyond the simple cashback schemes of yesteryear. With cutting-edge technology and a deeper understanding of consumer behavior, innovative reward programs are emerging as powerful tools, enabling individuals to significantly enhance their financial well-being simply by making everyday purchases. This guide will delve into these exciting new developments, exploring their mechanics, financial impact, and how you can best leverage them to your advantage.

The Evolution of Reward Programs in 2026

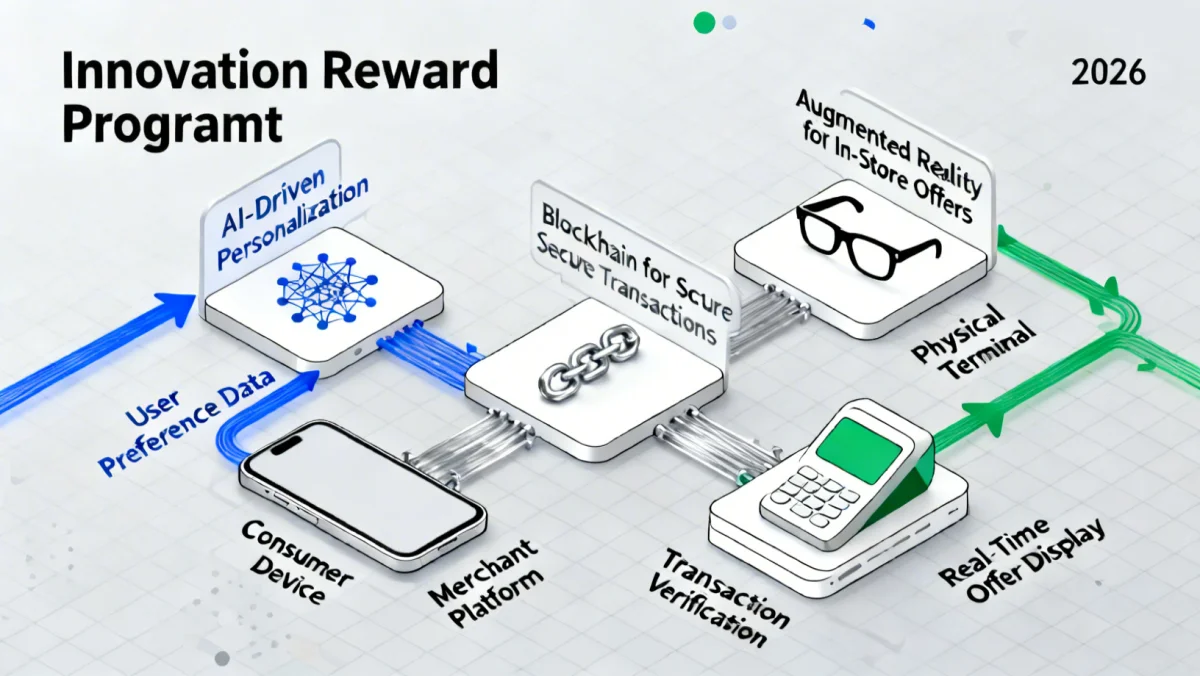

The concept of being rewarded for purchases is not new, but 2026 marks a pivotal moment in its evolution. Traditional loyalty programs often offered limited benefits, typically tied to specific retailers or accumulating points that were hard to redeem. However, the current wave of innovation has reshaped this, driven by advancements in artificial intelligence, blockchain technology, and data analytics. These programs are now more dynamic, personalized, and, crucially, more lucrative for the consumer.

No longer are rewards merely an afterthought; they are integrated seamlessly into the shopping experience, often influencing purchasing decisions. Consumers are becoming savvier, actively seeking out platforms that offer the best returns on their spending. This shift has pushed companies to innovate, creating a competitive environment that ultimately benefits the user with richer and more varied reward opportunities.

AI-driven personalization and predictive rewards

One of the most significant advancements is the integration of AI. Artificial intelligence now analyzes individual spending habits, preferences, and even future needs to offer highly personalized rewards. This means you might receive offers for products you genuinely need or want, rather than generic promotions. The system learns from your interactions, refining its recommendations over time.

- Tailored offers: AI identifies patterns in your purchases to present relevant deals.

- Predictive savings: Programs can anticipate future needs and offer discounts proactively.

- Dynamic pricing: Some platforms adjust reward rates based on demand or inventory.

The era of one-size-fits-all rewards is over. In 2026, your reward program acts almost like a personal financial assistant, guiding you toward optimal spending choices that maximize your returns.

The evolution also extends to the types of rewards offered. Beyond cashback, we’re seeing more experiential rewards, digital assets, and even direct contributions to investment portfolios. This diversification caters to a broader range of financial goals and lifestyles, making these programs appealing to a wider demographic. The core idea remains: spend, and get rewarded, but the ‘how’ and ‘what’ of those rewards have become far more sophisticated and impactful.

Understanding the Financial Impact of Innovative Programs

The financial impact of these new reward programs in 2026 cannot be overstated. For the average consumer, these are no longer just small bonuses; they represent a tangible increase in disposable income or savings. By strategically engaging with these platforms, individuals can transform routine expenditures into opportunities for financial growth.

Consider the cumulative effect. If a household spends several thousand dollars monthly on groceries, utilities, and entertainment, even a modest 2-5% return across various categories can amount to hundreds of dollars annually. When these returns are compounded or invested, the long-term benefits become even more substantial. This shifts the perception of spending from a pure outflow to a more circular model where a portion of the expenditure returns to the consumer.

Maximizing returns through strategic engagement

To truly harness the financial power of these programs, a strategic approach is essential. It’s not enough to simply sign up; active management and understanding of each program’s nuances are key. This involves comparing reward rates, understanding redemption options, and aligning your spending with the most lucrative opportunities.

- Diversify your portfolio: Use multiple apps and platforms to cover different spending categories.

- Track redemption values: Ensure you’re getting the best value when converting points or rewards.

- Stacking offers: Look for opportunities to combine rewards from different programs on a single purchase.

The financial gains also extend beyond direct cashback. Many programs offer exclusive discounts, early access to sales, or premium services that translate into indirect savings. For example, a travel rewards program might offer free upgrades or lounge access, enhancing the value of your travel without additional cost. This holistic view of benefits is crucial for understanding the full financial impact.

Key Technologies Driving 2026 Reward Programs

The technological backbone of 2026’s innovative reward programs is what truly sets them apart. These aren’t just minor upgrades; they are fundamental shifts powered by cutting-edge advancements. Understanding these technologies helps illuminate how these programs deliver such enhanced value and security to consumers.

At the forefront are artificial intelligence and machine learning, which enable the hyper-personalization discussed earlier. These systems process vast amounts of data to predict consumer behavior and tailor offers with unprecedented accuracy. This level of precision ensures that rewards are not only relevant but also highly motivating for the user, driving engagement and maximizing benefits.

Blockchain for transparency and security

Blockchain technology is increasingly being adopted to enhance transparency and security within reward ecosystems. By decentralizing transaction records, blockchain can prevent fraud, ensure the integrity of reward points, and simplify cross-platform redemption. This provides consumers with greater trust and control over their accumulated rewards.

- Immutable records: Transactions are permanently and transparently recorded.

- Fraud prevention: Reduces the risk of unauthorized redemption or manipulation.

- Interoperability: Facilitates easier transfer and redemption of rewards across different programs.

Furthermore, augmented reality (AR) and virtual reality (VR) are beginning to play a role, particularly in enhancing the in-store shopping experience. Imagine walking into a store and your reward app, through AR, highlights products with special offers directly on your phone screen, or even provides a virtual try-on experience that unlocks exclusive discounts. These immersive technologies make the process of discovering and utilizing rewards more engaging and immediate.

The integration of these advanced technologies ensures that reward programs are not just about giving back money, but about creating a smarter, more secure, and more enjoyable shopping experience that consistently delivers financial advantages.

Top Innovative Reward Platforms to Watch in 2026

As we navigate 2026, several platforms are leading the charge in redefining how we get paid to shop. These innovators are pushing boundaries, offering unique features and substantial returns that make them stand out in a crowded market. Identifying and utilizing these top-tier programs can significantly amplify your financial gains.

Many of these platforms leverage a blend of the technologies mentioned earlier, creating a seamless and highly effective user experience. They often prioritize ease of use, broad merchant networks, and diverse redemption options, catering to a wide array of consumer needs and preferences. Staying informed about these leaders is crucial for anyone looking to maximize their earning potential.

Platforms integrating crypto and NFTs as rewards

A notable trend is the emergence of platforms offering cryptocurrency or Non-Fungible Tokens (NFTs) as rewards. This taps into the growing interest in digital assets and provides an alternative to traditional cash or points. For those comfortable with the volatility of the crypto market, this can offer significant upside potential.

- Crypto cashback: Earn Bitcoin, Ethereum, or other altcoins on everyday purchases.

- NFT loyalty: Collect unique digital assets that unlock exclusive benefits or have resale value.

- Tokenized ecosystems: Participate in decentralized reward economies with community governance.

Other platforms are excelling with hyper-personalized cashback rates that dynamically adjust based on your shopping history and real-time market conditions. They might offer 10% back on groceries one week and 8% on dining the next, based on predictive analytics of your spending. This dynamic approach ensures that you’re always getting the best possible return on your most frequent expenditures, making every dollar spent work harder for you.

Navigating Privacy and Data Security in Reward Programs

While the benefits of innovative reward programs in 2026 are compelling, it’s essential to address the critical aspects of privacy and data security. These programs often rely on collecting and analyzing consumer data to provide personalized offers. Understanding how your data is used and protected is paramount to engaging with these platforms responsibly.

Reputable reward programs prioritize user trust by implementing robust security measures and transparent data policies. They typically adhere to strict regulatory frameworks regarding data privacy, ensuring that personal information is encrypted, anonymized, and used solely for the intended purpose of enhancing your reward experience. It’s crucial for users to review these policies before committing to any program.

Best practices for protecting your personal information

Taking proactive steps to safeguard your data is an important responsibility. While platforms are expected to protect your information, individual vigilance adds an extra layer of security and peace of mind. This involves careful consideration of what information you share and how you manage your accounts.

- Read privacy policies: Understand what data is collected and how it’s used.

- Use strong, unique passwords: Protect your reward accounts with robust credentials.

- Enable two-factor authentication (2FA): Add an extra layer of security to your logins.

- Monitor account activity: Regularly check for any suspicious transactions or changes.

Furthermore, many advanced reward programs are now incorporating privacy-enhancing technologies, such as federated learning, where AI models are trained on decentralized data without directly accessing individual user information. This approach allows for personalized recommendations while maintaining a higher degree of data privacy. The balance between personalization and privacy is a continuous area of development, with the best programs striving to offer both maximum benefits and maximum protection.

Future Trends and What to Expect Beyond 2026

The pace of innovation in reward programs shows no signs of slowing down, and looking beyond 2026, we can anticipate even more transformative changes. The trajectory points towards deeper integration with daily life, increased autonomy for consumers, and further blurring of lines between spending, saving, and investing. These future trends promise to make getting paid to shop an even more intrinsic part of our financial ecosystems.

One major area of development will be the continued evolution of personalized AI. Expect AI to not only suggest rewards but to actively manage your reward portfolio, automatically optimizing redemptions, transferring points to higher-value programs, or even investing small cashback amounts on your behalf. This level of automation will significantly reduce the effort required for consumers to maximize their benefits.

Seamless integration with smart home and IoT devices

Imagine your smart refrigerator automatically ordering groceries from a store that offers the best rewards, or your car’s navigation system suggesting gas stations with loyalty programs. The integration of reward programs with smart home devices and the Internet of Things (IoT) will create an ecosystem where earning rewards becomes almost entirely passive and automated.

- Automated purchasing: Devices make smart purchases based on reward optimization.

- Contextual offers: Real-time, location-based rewards delivered through connected devices.

- Predictive maintenance: IoT devices could trigger rewards for preventative services.

Another exciting prospect is the rise of truly universal reward currencies, potentially built on blockchain. This would allow consumers to earn a single, interoperable reward token that could be used across virtually any merchant or redeemed for any type of value, from cash to investments to unique experiences. This would eliminate the fragmentation of current reward systems and empower consumers with unprecedented flexibility.

The future of getting paid to shop is bright, promising a world where every transaction is an opportunity for financial gain, seamlessly integrated into our increasingly connected lives.

| Key Aspect | Description |

|---|---|

| AI Personalization | AI-driven offers tailored to individual spending habits for maximum relevance and value. |

| Blockchain Security | Ensures transparent, secure, and fraud-resistant reward transactions and point management. |

| Diverse Rewards | Beyond cashback, programs now offer crypto, NFTs, and experiential benefits. |

| Future Integration | Anticipate seamless rewards through smart home and IoT devices for passive earning. |

Frequently Asked Questions

Innovative reward programs in 2026 go beyond simple cashback, utilizing AI for personalization, blockchain for security, and offering diverse rewards like cryptocurrencies or NFTs. They focus on seamless integration into daily life and maximizing user benefits through advanced technology and predictive analytics.

These programs offer tangible financial benefits by turning everyday spending into opportunities for savings or growth. Strategic use can lead to significant cashback, valuable digital assets, or exclusive discounts, effectively increasing disposable income and enhancing overall financial well-being.

Reputable programs prioritize data security, employing encryption and adhering to privacy regulations. Many also use privacy-enhancing technologies like federated learning. Users should always review privacy policies, use strong passwords, and enable two-factor authentication for added protection.

Yes, many innovative reward platforms in 2026 are integrating digital assets. You can now earn various cryptocurrencies as cashback or collect unique NFTs that offer exclusive benefits or have potential resale value, catering to the growing interest in the digital economy.

Beyond 2026, expect deeper integration with smart home and IoT devices for automated earning, further AI-driven portfolio optimization, and the potential emergence of universal, interoperable reward currencies, making earning rewards even more passive and flexible.

Conclusion

The landscape of consumer rewards in 2026 represents a paradigm shift, offering unprecedented opportunities to get paid to shop. From AI-driven personalization to the security of blockchain and the advent of digital asset rewards, these innovative programs are transforming everyday spending into a powerful financial tool. By understanding these advancements, strategically engaging with leading platforms, and prioritizing data security, consumers can unlock significant financial benefits, making their money work harder than ever before. The future promises even more seamless integration and automation, ensuring that smart spending continues to be a rewarding endeavor.